Crypto sale tax calculator

Note our Cryptocurrency Tax Interactive Calculator is for estimation purposes only and allows you to get an estimate on one sales transaction at a time. California has a 6 statewide sales tax rate but also.

Crypto Tax Calculator Accointing Com

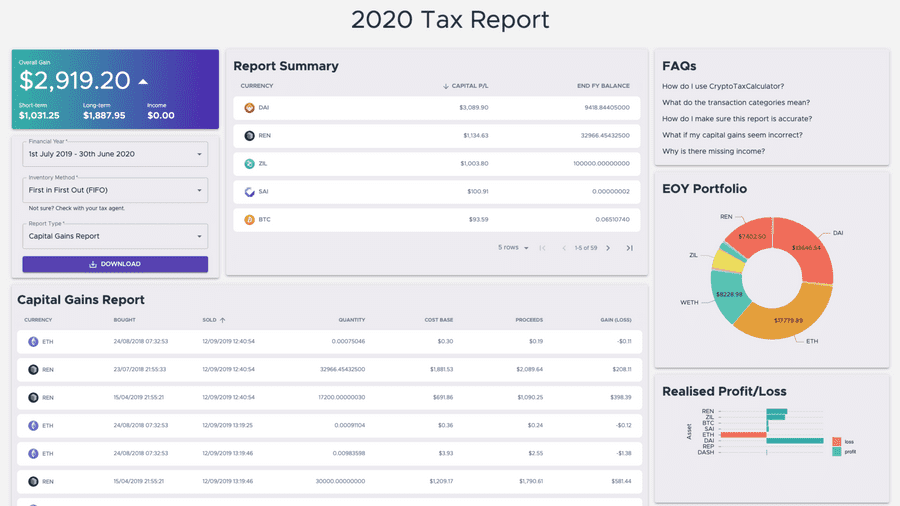

Select the financial year Enter sale value of the digital currency Enter the cost.

. Your Earnings Annual Salary Other Income Sources Gains from Crypto Sales Gains from Exchanging. Calculations are estimates based. Use our crypto tax calculator below to determine how much tax you might pay on crypto you sold spent or exchanged.

There are some strategies that you can use to minimize the results of using a crypto tax calculator including. Enter the cryptos purchase date and price this is necessary to determine if it will be taxed as a short-term gain or a long-term gain. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

If you have the calculator will automatically apply a 50 discount to your capital gain. If you held the cryptocurrency for a year or longer the gains. The Swyftx cryptocurrency tax calculator will ask you if youve held your crypto asset for 12 months.

This calculator is for any crypto traders operating as a business or professional trader. How to Minimize Your Crypto Taxes. USA Your cryptocurrency tax rate on federal taxes will.

Import all your cryptocurrency exchange trade history as well as any transactions made off-exchange. Los Angeles is located within Los Angeles County. Input your state tax rate.

This includes the rates on the state county city and special levels. To use the Tax2win cryptocurrency tax calculator all you have to do is follow the below-mentioned steps. Under Add A Sale.

Enter your taxable income excluding any profit from Bitcoin sales. The official Crypto Tax Accountant directory. If you owned the cryptocurrency for less than a year before selling it the gains would be taxed at a rate equal to your income tax rate.

Are you in need of a tax professional who specializes in bitcoin and cryptocurrencies. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you. The average cumulative sales tax rate in Los Angeles California is 952.

These are the basic steps of using a crypto tax calculator. June 27 2022. First there must be a taxable crypto transaction such as selling the cryptocurrency before it can be taxed.

Select your tax filing status. Select the tax year you would like to calculate your estimated taxes. Calculate Your Crypto Taxes.

Crypto Tax Calculator Australia 2022 Calculate Profit And Tax For Free Marketplace Fairness

Top 8 Crypto Tax Software Alternatives To Cointracking Updated 2021 Coincodex

Github Davidosborn Crypto Tax Calculator A Tool To Calculate The Capital Gains Of Cryptocurrency Assets For Canadian Taxes

Cryptocurrency Taxation In Canada In 2022 Cryptocurrency Capital Assets Goods And Services

Capital Gains Tax Calculator 2022 Casaplorer

How To Calculate Crypto Taxes Koinly

Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

Calculator And Coins Payroll Taxes Income Tax Preparation Business Tax

Llc Tax Calculator

Crypto Tax Calculator

Capital Gains Tax Calculator Ey Us

Best Crypto Tax Software Top Solutions For 2022

Cryptocurrency Tax Calculator Forbes Advisor

How To Calculate Crypto Taxes Koinly

Crypto Tax Calculator

How To Calculate Cost Basis In Crypto Bitcoin Koinly

Cryptocurrency Taxes What To Know For 2021 Money