40+ How much mortgage i can get approved for

A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. How much mortgage might I qualify for.

Amp Pinterest In Action Contract Template Contract Agreement

Provide details to calculate your affordability.

. For a home worth 377700 that translates into a property tax payment of. Total income before taxes for you and your household members. How much house you can afford is also dependent on.

While many lenders cap the amount that you are able to. When it comes to calculating affordability your income debts and down payment are primary factors. For example in 2018 the average homeowners insurance plan cost 1249 per year or 104 per month.

Interest rate This is. This can be anywhere from 10 years to 30 years but entering 30 years will have the lowest payments and enable you to qualify for the highest loan amount. The question of how much mortgage one can qualify for can often be a trap as it is a question that will vary from lender to lender.

NerdWallets mortgage payment calculator can help you determine what your monthly payments would be if you bought a 400000 home and it shows how this figure changes based on. Payments you make for loans or other debt but not living expenses like. FHA loans are insured by the Federal Housing Administration.

As you can see from the bottom table with a higher amount of student loan debt you need a higher down payment to be able to qualify for a low mortgage. Factors that impact affordability. Your debt-to-income ratio DTI should be 36 or less.

Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross income. This is for things. Your housing expenses should be 29 or less.

Were not including any expenses in estimating the income you. How Much Income Do You Need To Qualify For A 400000 Mortgage To qualify for a 400000 mortgage you would need approximately 90000 in qualifiable gross household. In California the average annual property tax payment in 2019 was.

Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. FHA loans often qualify borrowers whose credit scores are above 580 a realistic number for many first-time homebuyers.

Your mortgage payment should be 28 or less. In California the average annual property tax payment in 2019 was 070 of the homes value.

I Pinimg Com 564x Ef 11 Ee Ef11eeba2f91bd87f6d3caa

Printable Sample Loan Agreement Form Form Contract Template Letter Of Intent Words

40 Catchy Pre Approve Mortgage Slogans List Phrases Taglines Names Aug 2022

Amazon Prime Day 2022 Is Coming Shop The 40 Best Early Amazon Deals Before July 12

40 Things Every 40 Should Know About Buying A Home Gobankingrates

40 Things Every 40 Should Know About Buying A Home Gobankingrates

Become A Mortgage Loan Originator 6 Step Guide

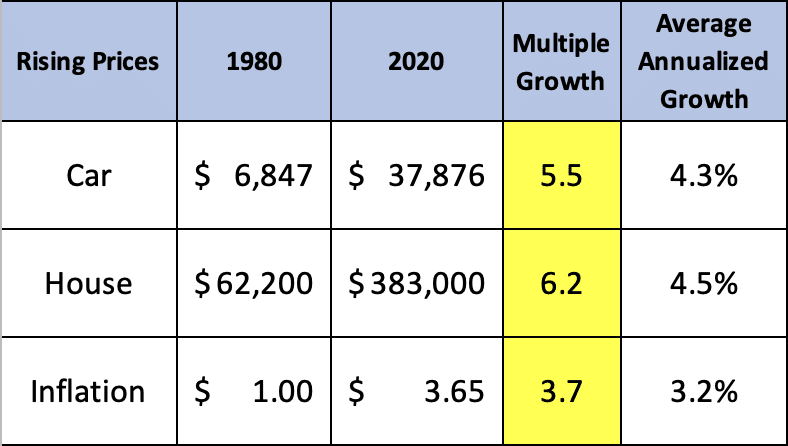

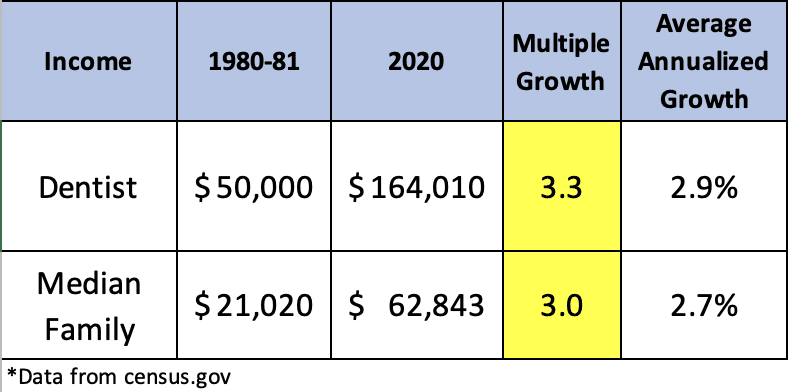

How Dental School Costs Have Changed Over 40 Years Student Loan Planner

Mortgage Loans Real Estate Business Plan Loan

Tradelines 101 Infographic Tradelines Credit Card Hacks Paying Off Credit Cards

40 Things Every 40 Should Know About Buying A Home Gobankingrates

40th Birthday 40 Years Of Being Awesome Square Sticker Zazzle 46th Birthday 47th Birthday Birthday Logo

40 Things Every 40 Should Know About Buying A Home Gobankingrates

Sinking Funds Tracker Spreadsheet Sinking Funds Template Etsy Video Video Monthly Budget Template Sinking Funds Money Management

How Dental School Costs Have Changed Over 40 Years Student Loan Planner

Tips Tricks Tuesday In 2022 Real Estate Tips Selling House Tips

One Hour For One Month S Worth Of Homemade Baby Food 40 Stage 1 Recipes Baby Food Recipes Homemade Baby Foods Baby Food Recipes Stage 1